The cryptocurrency market has undergone significant transformation since its inception, marked by notable milestones and rapid technological advancements. Investors face a complex landscape, characterized by high volatility and evolving regulatory frameworks. Understanding these dynamics is essential for making informed decisions. As the sector continues to mature, it raises critical questions about its future trajectory and potential implications for the global financial system. What strategies will emerge to navigate this unpredictable environment?

Understanding Cryptocurrency: Its Evolution and Key Milestones

Although the concept of cryptocurrency emerged relatively recently, its evolution has been marked by significant milestones that reflect both technological advancements and shifts in public perception.

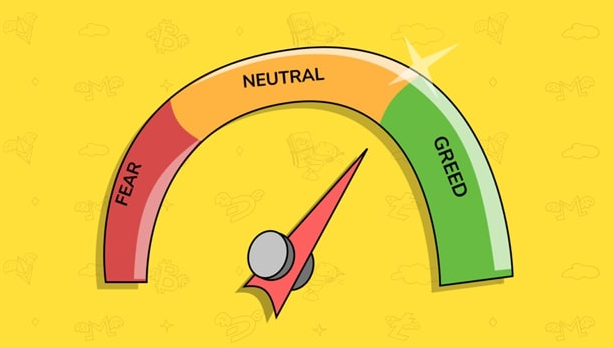

Key developments include the rise of blockchain technology, which enhances security and transparency, and the increasing market volatility, influencing investor behavior.

This dynamic landscape underscores the ongoing quest for financial freedom and innovation within digital currencies.

See also: pragatizacao

Key Lessons From Cryptocurrency’s Growth: What Investors Should Know

Numerous lessons can be gleaned from the rapid growth of cryptocurrency, providing valuable insights for potential investors.

Understanding effective investment strategies is crucial, as market volatility can significantly impact returns.

Diversification, timing, and risk assessment are essential components of a sound approach.

Investors must remain adaptable and informed, leveraging data analytics to navigate the unpredictable landscape of cryptocurrency effectively, ensuring financial freedom.

Navigating the Regulatory Landscape: Future Challenges in Cryptocurrency

As the cryptocurrency market continues to evolve, the regulatory landscape poses significant challenges that investors must navigate to ensure compliance and safeguard their investments.

Regulatory compliance is becoming increasingly complex amid rising market volatility, necessitating adaptive strategies.

Investors must stay informed about shifting regulations while balancing the need for innovation and the desire for financial freedom, ensuring they remain ahead in this dynamic environment.

What’s Next for Cryptocurrency? Trends and Predictions for the Future?

Anticipation surrounds the future of cryptocurrency as emerging trends and technological advancements shape the market.

Decentralized finance (DeFi) continues to gain traction, offering users enhanced financial autonomy.

Simultaneously, blockchain scalability remains a pivotal focus, with solutions like sharding and layer-2 protocols poised to address transaction speed and costs.

These innovations could redefine financial systems, fostering broader adoption and empowering individuals globally.

Conclusion

In conclusion, the cryptocurrency landscape is marked by rapid evolution and significant potential, yet fraught with volatility and regulatory uncertainty. As investors consider their strategies, one must ask: how will they adapt to the shifting tides of this digital economy? By prioritizing diversification and remaining informed on emerging trends, investors can better navigate the complexities of cryptocurrency. Ultimately, the future of finance hinges on the ability to balance opportunity with caution in this dynamic market.